What is Working Capital? |

|

|

Welcome to the Investors Trading Academy talking glossary of financial terms and events.

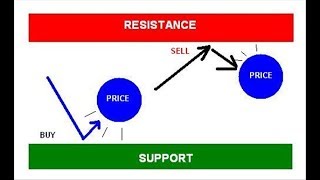

Our word of the day is “Working Capital” Working capital is a common measure of a company's liquidity, efficiency, and overall health. Because it includes cash, inventory, accounts receivable, accounts payable, the portion of debt due within one year, and other short-term accounts, a company's working capital reflects the results of a host of company activities, including inventory management, debt management, revenue collection, and payments to suppliers. Positive working capital generally indicates that a company is able to pay off its short-term liabilities almost immediately. Negative working capital generally indicates a company is unable to do so. This is why analysts are sensitive to decreases in working capital; they suggest a company is becoming overleveraged, is struggling to maintain or grow sales, is paying bills too quickly, or is collecting receivables too slowly. Increases in working capital, on the other hand, suggest the opposite. There are several ways to evaluate a company's working capital further, including calculating the inventory-turnover ratio, the receivables ratio, days payable, the current ratio, and the quick ratio. One of the most significant uses of working capital is inventory. The longer inventory sits on the shelf or in the warehouse, the longer the company's working capital is tied up. By Barry Norman, Investors Trading Academy - ITA |