Why Pursuing High Volatility Can Be Rational in Portfolio Theory |

|

|

Dive into the unconventional wisdom of high-volatility investments with our latest episode! 📈💡

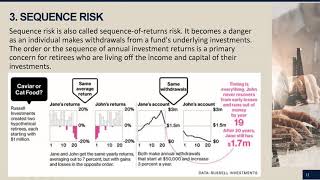

Discover why sometimes, embracing the rollercoaster ride of high-risk assets can be a strategic move in achieving your financial goals. Whether you're a seasoned investor or just curious about the mechanics of portfolio theory, this video sheds light on a different angle of rational investment strategies. Don't miss out on this insightful journey into the realm of finance! Engage With Us: Ever wondered if chasing high volatility in investments is just for the thrill-seekers, or if there's a method to the madness? Join us as we dive into the rationality behind embracing high volatility in portfolio theory. It's not just about the rush; it's about reaching goals that only high-risk ventures can achieve. Subscribe and Join the Conversation: Hit subscribe to stay ahead in the financial game with more insights like these. Discover strategies that defy traditional portfolio theories and open up new avenues for achieving your financial ambitions. Remember:High volatility isn't just a gamble; it's a calculated move for those aiming for the stars. Watch now to understand why sometimes, the riskiest moves are the most rational. @DirectionalAdvisors #Franklin J. Parker interview, #goals-based investing, #personalized financial planning, #wealthmanagement strategies, #investment portfolio customization, #tax efficiency in investments, #financial literacy podcast, #moneymatterspodcast , #Wealth preservation techniques, #intergenerational wealth transfer |