HOW CASH FLOW KEEPS YOU POOR! | My Real Estate Investing Strategy |

|

|

HOW CASH FLOW KEEPS YOU POOR! | My Real Estate Investing Strategy

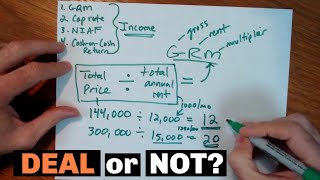

In this video, I share with you why believe cash flow is overrated and the real estate investing strategies I use. Instagram: www.instagram.com/theoutofstateinvestor Tiktok: www.tiktok.com/@Theoutofstateinvestor The first part of my real estate strategies is buying rental property out of state. I like to target markets where it's possible to get a 10% cash on cash return but also be primed for above average long term appreciation. When you're buying a house to rent out, it's important to also consider the specific neighborhood you're targeting. I look for up and coming gentrifying neighborhoods. This is because they are changing very rapidly and can offer fast short term appreciation because of the local flippers flipping houses there along with the city investing millions of dollars in redevelopments. Using that strategy has proven to be successful for me when buying property out of state. Now the other part of my investment property strategies is I like to utilize my primary residences as a long term investment. I like to live in my primary residence for a year or two, and then move out, rent the property out, and buy another house with a low downpayment. The other part of this property investment strategy is I like to look for houses that I can fix up and add value to. This allows me to add equity to the property and I can refinance, remove the PMI (Private Mortgage Insurance) and maybe get some cash back in my pocket or I can use a HELOC (Home Equity Line of Credit). This is a crucial part of my rental property investing strategies because it allows me to continue to scale, tap into the new equity I created and keep buying more houses. These 2 things are on a macro level what my rental property investment strategy looks like. Buy focusing more on appreciation on the front end but using cash flow to mitigate risk, it allows me to experience more long term growth which eventually I will sell these primary residences, use a 1031 exchange and convert them into cash flowing apartment complexes. #RealEstateInvesting #CashFlow #RichVsPoor |