How to trade Options: Delta Explained |

|

|

How to trade Options: Delta Explained

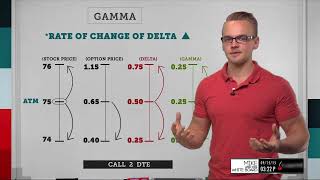

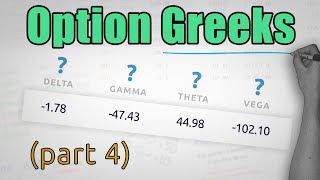

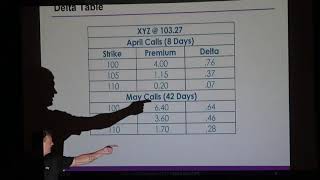

❤️ Get 17 Free stocks with moomoo 🚀 ► https://j.moomoo.com/00hxeB 💰 Australia Residents MooMoo LINK ► https://j.moomoo.com/00kPum ____________________________________________________________ 🎓 STOCKS FOR BEGINNERS: https://stock-up-u.teachable.com/p/investing-the-ultimate-beginners-course Delta is the theoretical estimate of how much an option's value may change given a $1 move UP or DOWN in the underlying security. The Delta values range from -1 to +1, with 0 representing an option where the premium barely moves relative to price changes in the underlying stock. What is a good Delta for options? Call options have a positive Delta that can range from 0.00 to 1.00. At-the-money options usually have a Delta near 0.50. The Delta will increase (and approach 1.00) as the option gets deeper ITM. The Delta of ITM call options will get closer to 1.00 as expiration approaches. Is high Delta good for options? Generally speaking, this means traders can use delta to measure the directional risk of a given option or options strategy. Higher deltas may be suitable for higher-risk, higher-reward strategies that are more speculative, while lower deltas may be ideally suited for lower-risk strategies with high win rates. DISCLAIMER: I am not a financial advisor. These videos are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment. Keywords: moomoo review, is moomoo safe, moomoo option trading, moomoo delta explained, chat group on moomoo, spx analysis, spx charting, spx ta, moomoo option greeks, moomoo options review #optionstrading #delta #moomoo #moomootrading |

![How to Use "Delta" In Option Trading Like a Pro [SUPER IMPORTANT] | Episode 223](https://ytimg.googleusercontent.com/vi/ak9ATe3d0eo/mqdefault.jpg)