2021 Budget update: Personal Taxes, Capital Gains Tax, Inheritance tax. |

|

|

Burton Sweets expert Bristol-based accountant and business advisor will explain Rishi Sunak's 2021 Budget.

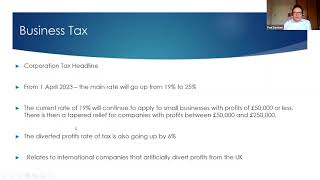

Please view part 1 and 2 of this video series; ➤Part 1: Key Budget Announcements and Recovery Proposals: https://youtu.be/dw8umnQV1OA ➤Part 2: Company and Business Tax Changes: https://youtu.be/eM9hffLKJXo Everything this video talks about is covered on the burton sweet website on the following link: https://www.burton-sweet.co.uk/budget-2021-highlights/business/ 00:00 Introduction 01:04 2021 Budget Announcements 01:48 Updated Income Tax Personal Allowances (except Scotland) 02:15 Income Tax Bands and Rates 03:37 Personal Pension allowances 05:10 ISAs Updates 06:33 Capital Gains Tax (CGT) 07:56 Inheritance Tax (IHT) - Trust & Estates 10:10 Will and Lasting Power of Attorney 11:03 Trusts and Trustees 12:13 Stamp Duty Land Tax (SDLT) changes 13:46 2021 Budget: Personal Taxes Summary Links: ➤Tax Rates And Allowances 2021/22: https://www.burton-sweet.co.uk/tax-rates-and-allowances-2021-22/ ➤Capital Gains Tax Rates: https://www.burton-sweet.co.uk/taxrates/capital-gains-tax-cgt/ ➤Income Tax Allowances: https://www.burton-sweet.co.uk/taxrates/income-tax-allowances/ ➤Individual Savings Account (ISA) limits: https://www.burton-sweet.co.uk/taxrates/individual-savings-account-isa/ |