Generate E-Way Bill & E-Invoicing in Tally Prime 3.0 |

|

|

#ewaybill #E-invoicing #accounting #gst #commercejournal #tallyprime

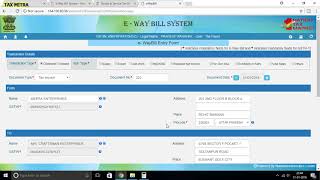

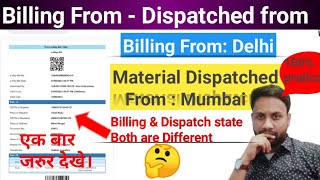

Processe- to generate e-way bill & E- invoicing in Tally Prime:- Record a GST Sales transaction, as usual. Under Party A/c name, select the party. The Dispatch Details screen will appear. Enter the required details and press Enter. The Party Details screen will appear. This will be prefilled as per the information provided in the party ledger. Update the Party Details, if required, and press Enter to proceed to the transaction. To know how to use the multiple GST registrations feature during voucher creation, refer to the Enable GST for Your Company – Single and Multi-Registration section in the Getting Started with GST in TallyPrime topic. Specify other voucher details, such as the Sales ledger, Name of Item, GST ledger, and so on. Set the option Provide GST/e-Way Bill details to Yes. The Additional Details: Sales Taxable screen will appear. The e-Way Bill will be generated based on the details entered in this screen. Dispatch from and Ship to: This will be prefilled based on the address provided in the Company and Party ledger, respectively. You can update this, if required. Distance (in Km): This is the distance between the addresses of the Consignor and Consignee. The validity of your e-Way Bill depends on the distance entered in this field. The next time you record a transaction for this party, the distance will be prefilled based on the address and PIN code entered in the Party ledger. If you are using TallyPrime Release 3.0 or later releases, then press Alt+L (Calculate Distance on Portal) and TallyPrime and you will be redirected to the link on the portal on which you can calculate the distance by providing the pin of both the places. Transporter Name: Select the Transporter Name. You can set it as None if you are transporting the goods using your own or hired vehicle, or if you are using a different mode of transport such as Rail, Air, or Ship. Transporter ID: Enter the Transporter ID provided by the transporter. If Part B Details are available, then you can enter the following details. Mode: Select the mode of transport, such as Road, Rail, Air, or Ship. You can also create a New Mode, if required. Vehicle Number: Specify the number of the vehicle used for transporting the goods. Vehicle Type: Specify the size of the vehicle, such as Regular, Over Dimensional Cargo, and so on. You can also create a New Vehicle Type, if required. For More Information- Call us @9355386888 mail us @commercejournalindia@gmail.com |