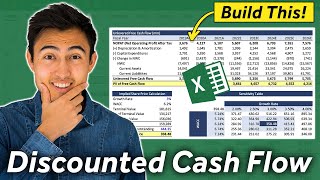

Build A Full Discounted Cash Flow Model for a REAL Company |

|

|

Create a full discounted cash flow valuation model from scratch on Excel.

📈 The Complete Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course 🆓 DOWNLOAD Free Excel file for this video: https://view.flodesk.com/pages/62bffa6d7edfa6aa840e1fc2 In this video you'll learn to do a full discounted cash flow (DCF) valuation on a real company. First, we gather all the data. In this case it's the three financial statements from the company's annual report. Second, we begin forecasting the free cash flows. In order to do so, we create revenue projections, as well as a fixed assets schedule and a net working capital projection. Third, we calculate the WACC, short for the weighted average cost of capital in order to discounted all the future cash flows back to the present value. Fourth, we calculate the terminal value, which is the value of the company after the forecast period. Then, we discounted the TV and the FCFs to get the enterprise value. Lastly, we calculate an implied share price by going from enterprise value to equity value, and dividing by the diluted shares outstanding. Finally, we create a sensitivity table to see how chaining the WACC and the growth rate affects our valuation. LEARN: 📈 The Complete Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course 👉 Excel for Business & Finance Course: https://www.careerprinciples.com/courses/excel-for-business-finance 📊 Get 25% OFF Financial Edge Using Code KENJI25: https://bit.ly/3Ds47vS SOCIALS: 📸 Instagram - https://www.instagram.com/kenji_explains/ 🤳 TikTok - https://www.tiktok.com/@kenjiexplains?lang=en GEAR: 📹 My Favorite Books & Gear: https://kit.co/kenjiexplains ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ Chapters: 0:00 - Projecting cash flows 3:28 - Fixed Assets Schedule 5:35 - Calculating Free Cash Flow 15:42 - Calculating the WACC 22:52 - Calculating the Terminal Value 25:12 - Calculating an Implied Share Price 26:34 - Sensitivity Table Disclaimer: I may receive a small commission on some of the links provided at no extra cost to you. |

![Financial Modeling Quick Lessons: Building a Discounted Cash Flow (DCF) Model (Part 1) [UPDATED]](https://ytimg.googleusercontent.com/vi/XL71PBhcs2M/mqdefault.jpg)

![Financial Modeling Quick Lessons: Building a Discounted Cash Flow (DCF) Model (Part 2) [UPDATED]](https://ytimg.googleusercontent.com/vi/bCCrACXrVPQ/mqdefault.jpg)