Capital Gains on Selling a House Explained - How to Avoid Taxes |

|

|

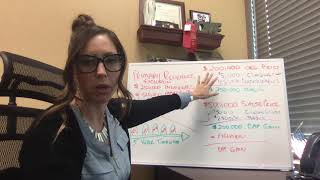

Capital Gains on Selling a House

Capital Gains Tax Real Estate Explained This video discusses the taxes on a sale of house. It depends if you sold a primary residence, rental property, a 1031 exchange, or a flip transaction. The tax on the property sale will be different for each one of these transactions with the IRS. This video is a great compliment to real estate agents and brokers. This is a great educational video for real estate investors and those interested in real estate investing. So please know and understand the primary residence exclusion and how it applies. Please leave us any questions in the comment section, thank you! Please visit us at https://www.cvtaxpreparation.com To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this communication is not intended to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code or promoting, marketing, or recommending to another party any transaction or matter addressed herein. The information provided in this video should not be construed or relied on as advice for any specific fact or circumstance. This video is designed for entertainment and information purposes only. Viewing this video does not create an accountant-client relationship. You should not act or rely on any of the information contained herein without seeking professional consultation. |

![How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]](https://ytimg.googleusercontent.com/vi/VFqIr0GQKSk/mqdefault.jpg)

![Capital Gain Exclusion: Selling Old Primary Residence Converted into a Rental [Tax Smart Daily 051]](https://ytimg.googleusercontent.com/vi/GcGSX_QmIk8/mqdefault.jpg)