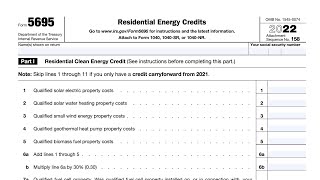

The Solar Energy Tax Credit | A How To Video | 1040 Attachment 5695 |

|

|

Did you have solar installed on your home last year? If so, you are eligible to take the Solar Energy Tax Credit, officially named, the Residential Energy Efficient Property Credit.

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax credit.) The tax credit expires starting in 2024 unless Congress renews it. In this video, I show you how I added this credit to my 2020 taxes using H&R Block Online and the completed Form 1040 Attachment 5695. Please like, comment and subscribe to Tesla Family Channel here on YouTube. Follow: https://twitter.com/TeslaFamilyChan, Like: https://facebook.com/TeslaFamilyChannel As of November 2022, Place an order for Tesla products through Shawn's referral link: https://www.tesla.com/referral/shawn68886 and earn credits upon delivery of your car or activation of your solar system. Redeem your credits for awards in the Tesla Referral Shop! #Solar #Tax #Credit |

![The Solar Tax Credit Explained [2023]](https://ytimg.googleusercontent.com/vi/ZHYfnO1hBNg/mqdefault.jpg)

![The Solar Tax Credit Explained [2024]](https://ytimg.googleusercontent.com/vi/ZlxSkEvlNnQ/mqdefault.jpg)

![How Does The Solar Tax Credit Work? [Solar Tax Credit Explained 2023]](https://ytimg.googleusercontent.com/vi/xwtby-h6cA0/mqdefault.jpg)

![The Solar Tax Credit Explained [2022]](https://ytimg.googleusercontent.com/vi/u46G0bvoXlY/mqdefault.jpg)