Bank Rate (RBI) - Explained in Hindi |

|

|

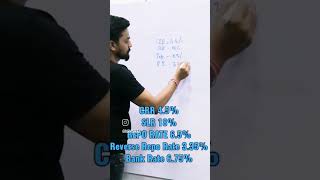

What is Bank Rate of RBI? Explained in hindi. Reserve Bank of India publishes bank rate in addition to Repo Rate, Reverse Repo Rate and Marginal Standing Facility (MSF Rate). Bank Rate is generally used as a discount rate and penal interest in case a Bank is not able to maintain its CRR and SLR requirements.

Sign-up to our new app for discounts and early access: ✔ https://assetyogi.com/sign-up/ ----------------------------------------------------------------------------------- Related Videos: NDTL (Net Demand and Time Liabilities) - https://youtu.be/KzGIDM4FWBY CRR & SLR (Cash Reserve Ratio & Statutory Liquidity ratio) - https://youtu.be/RLrtEtDXVgE Repo Rate & Reverse Repo Rate (Liquidity Adjustment Facility) - https://youtu.be/6SWCw_DrPhw RBI का Bank Rate क्या है? हिन्दी में समझाया गया है। RBI; repo rate,reverse repo rate and marginal standing facility के अलावा Bank Rate को publish करता है। Bank Rate आमतौर पर discount rate और penal interest के रुप में use की जाती है यदि bank इसके CRR और SLR आवश्यकताओं को बनाए रखने में सक्षम नहीं है। Share this video: https://youtu.be/FUtB-xvTe0w Subscribe To Our Channel and Get More Property, Real Estate and Finance Tips: https://www.youtube.com/channel/UCsNxHPbaCWL1tKw2hxGQD6g To access more learning resources on finance, check out www.assetyogi.com In this video, we have explained: What is meant by Bank Rate? Who will decide the Bank Rate? Why has the significance of bank rate reduced? How is the bank rate linked to the repo rate? What is the purpose of bank rate? Difference between Bank Rate and Repo Rate ? What is current Bank Rate of India? Is Bank Rate same as Repo Rate? What is Penal Rate? In the past, bank rate was the key policy rate that gave direction to market interest rates. Now repo rate is the key policy rate. If repo rate increases means RBI wants to reduce inflation.All interest rates depend on the repo rate . Even bank rate is also linked with repo rate. Now it serves mainly two purposes: 1. It serves as the discount rate for bills of exchange and commercial papers 2. It serves as the penal rate for banks if they don't fulfil SLR and CRR requirements. Make sure to like and share this video. Other Great Resources AssetYogi – http://assetyogi.com/ Follow Us: Pinterest - http://pinterest.com/assetyogi/ Instagram - http://instagram.com/assetyogi Google Plus – https://plus.google.com/+assetyogi-ay Linkedin - http://www.linkedin.com/company/asset-yogi Facebook – https://www.facebook.com/assetyogi Twitter - http://twitter.com/assetyogi Hope you liked this video in Hindi on “Bank Rate (RBI)”. |