Major Trend Reversals - Simple and Powerful Techniques |

|

|

A reversal is a change in the price direction of an asset you are trading. A reversal can occur to the downside or the upside. Following an uptrend, a reversal would be to the downside. Following a downtrend, a reversal would be to the upside. Reversals are based on overall price direction and are not typically based on one or two bars on a chart.

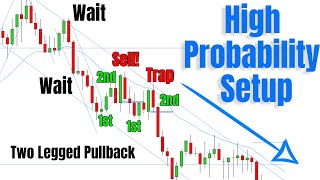

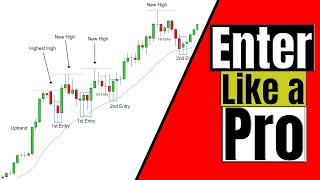

When looking for reversal it is important to realize that reversal are countertrend entries. And as we all know countertrend entries are very risky and sticking with the trend is the best strategy. Therefor when looking for reversal a trader needs a safe place to enter. In this videos I am going to try to explain where the safest place to enter is - reversal pattern. First we need to let the current trade finish. End of the trend happens after a break and a new extreme. Just because there is break of a trendline does not mean a trader can safely countertrend trade. That is too early. After new extreme price action rules are telling is there is time for correction or possibly a reversal. If prices go through the EMA and then EMA holds prices, that is a good sign market may be reversing and sides might be switching. The final piece of the puzzle regarding reversal is a trader should be looking for failed 2 attempts in the direction of a previous trend. If after a break and a new extreme there is a failed 2nd entry in the direction of previous trend now trader can safely enter reversal trade. Date October 11 2021 2000 Tick Chart ES Futures S&P 500 If you enjoyed this video and find it helpful can SUBSCRIBE and learn more about trading. Enjoy the videos. The best way to became consistantly profitable is to learn to read the chart in its purest form. There is no holy grail or set of indicators that can make you rich without work. Learning to understand how prices move and why they move is a learnable skill that anyone can achieve. OUR PRICE ACTIONS RULES WORK IN EVERY MARKET AND EVERY TIMEFRIME. Priceaction is universal and technical analysis patterns repeat over and over again on consistent basis. Trading with a fear is the most common fear most trade have. It is crippling and can get your mind frozen. The key to consistancy is to be emotionless and fear nothing in trading. Money Management Target Profit - 8-10 Ticks Stop Loss - below signal bar (around 10 ticks) Overall market context is more important than individual patterns. Technial analysis works and it repeats over and over. #ReversalTrading #TechnicalAnalysis #PriceActionTrading |