Capital Budgeting: Payback Period, ARR, NPV, Profitability Index and IRR- Part I |

|

|

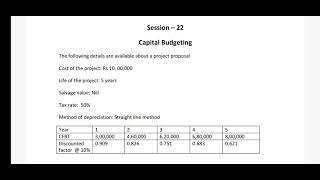

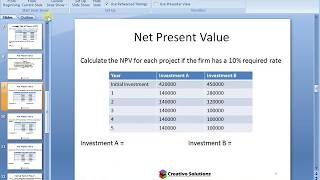

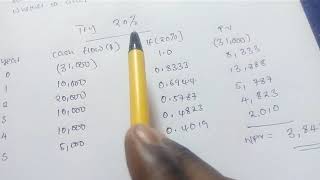

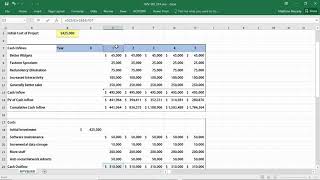

A company is considering an investment proposal to install new milling controls at a cost of Rs 50,000. The facility has a life expectancy of 5 years and no salvage value. The tax rate is 35%. Assume the firm uses straight line depreciation and the same is allowed for tax purposes. The estimated cash flows before depreciation and tax (CFBT) from the investment proposal are as follows:

Year 1 2 3 4 5 CFBT (in Rs) 10,000 10,692 12,769 13,462 20,385 Compute the following: a) Pay back period b) Average rate of return c) Internal Rate of Return d) Net Present Value at 10% discount rate. e) Profitability Index. |

Internal Rate of Return (IRR) | PBP | NPV | Model Question Solution | BBS 2nd year Finance Chapter 8

![[#6] IRR - Internal Rate of Return method in Capital Budgeting | Solved example | by kauserwise®](https://ytimg.googleusercontent.com/vi/d78CxLf8J6M/mqdefault.jpg)