Working capital management |

|

|

What is working capital management? Let’s start off with a definition of #workingcapitalmanagement, and then go through some very practical ideas of managing working capital in real life.

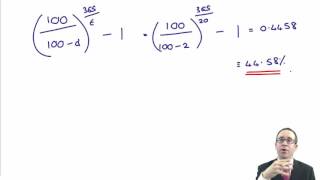

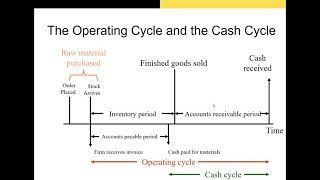

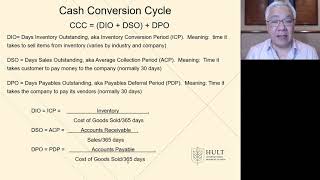

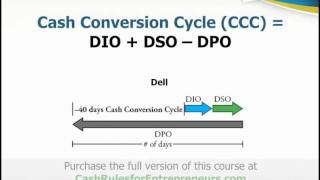

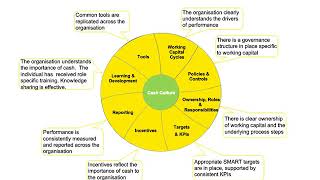

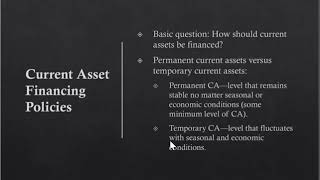

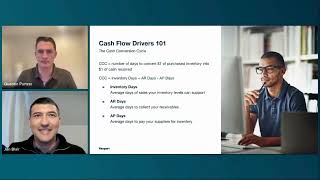

Working capital management: operating efficiently by using working capital to the best effect. That’s a definition that includes two items that need further definition. What is working capital, and what does “to the best effect” mean? There are multiple answers to both of these! Let me show you! ⏱️TIMESTAMPS⏱️ 0:00 Definition of working capital management 0:35 Two definitions of working capital 1:24 Goals for working capital management 2:09 Measuring the operating cycle 2:56 Cash conversion cycle 3:15 Improving inventory management 3:50 Improving receivables management 4:18 Improving DPO 4:58 Working capital vs profitability 6:05 Receivables factoring 7:40 Supplier financing Working capital tends to get defined in textbooks as the current assets on a company’s balance sheet minus its current liabilities. Current assets include items such as cash, marketable securities, accounts receivable, inventory, and prepaid expenses. Current liabilities include items such as short-term debt, accounts payable, accrued liabilities, and deferred revenue. Yes, that’s a lot of financial terms on one page. Fear not! There is a much more practical definition, used in everyday business life, that focuses on those items that are (in real life) often the largest in amount: accounts receivable, plus inventory, minus accounts payable. Now that we know what working capital is, how do we manage working capital to the best effect? Three options. Aim to lower working capital to maximize cash flow. Aim for a higher working capital to maximize profitability. Or outsource working capital altogether and focus on other strategic areas that require top management attention. Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In! |