Working Capital Assumptions in a Financial Model |

|

|

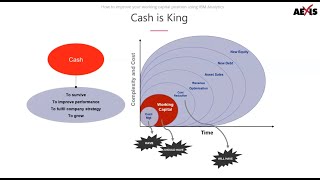

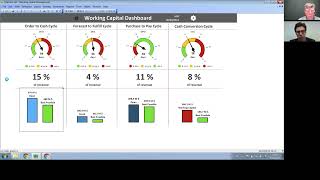

This video explores important variables to keep in mind when you are developing working capital assumptions for the projected period in a financial model. The purpose of this introduction is to encourage you to think through how working capital decisions impact cash flow. As an analyst, you should be comparing a company’s working capital balances to industry standards and to the competition.

So, what should you be looking for when you are developing working capital assumptions for the balance sheet? This video is focused on three items to be cognizant of when building this schedule for a “quick” LBO exercise: relevant data, large fluctuations in working capital accounts and opportunities to optimize working capital. This video builds off the video series focused on the three-statement model. If you are more focused on the mechanics of projecting working capital (i.e., Excel formulas), please see this video series: https://www.asimplemodel.com/model/2/integrating-financial-statements/ How Seasonality Impacts Working Capital and Cash Flow: https://www.youtube.com/watch?v=sDx49v2OYWQ Excel Template and PDF Notes (ASM Subscriber Content): https://www.asimplemodel.com/model/20/lbo-model-the-projected-period/ LBO Case Study: https://www.asimplemodel.com/model/83/leveraged-buyout-model/lbo-case-study-babyburgers-llc/ Private Equity Training: https://www.asimplemodel.com/PrivateEquity LINKEDIN: https://www.linkedin.com/company/ASimpleModel INSTAGRAM: https://www.instagram.com/ASimpleModel FACEBOOK: https://www.facebook.com/ASimpleModel |