1031 Exchange & Capital Gains Tax |

|

|

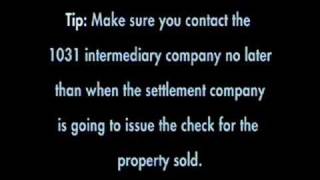

When you do a 1031 tax exchange it can save you capital gains tax and recapture depreciation tax. Taxes without a 1031 exchange can range 15 to 25 percent. They will be higher the more valuable your investment property or if you've claimed depreciation on the asset you're exchanging. Learn how to save money with a 1031 exchange.

|