Capital Gains Tax (CGT) rates and allowances |

|

|

In this video you will learn from Simon Misiewicz, your property tax specialist, of Optimise Accountants

▶ What Capital Gains Tax is and how it is applied to you when you sell assets such as a buy to let property. ▶ Since the 2020 budget announcement was made by Rishi Sunak the Chancellor of the Exchequer there have been a few changes that have been made to the Capital Gains Tax allowances, Capital Gains Tax rates and how CGT is to be paid in the future. ▶ Each person is now allowed an Annual Capital Gains Tax allowance of £12,300. This means that a person can make a profit on an asset of £12,3oo and not pay any tax at all ▶ A basic rate tax payer will have a capital gains tax rate of 18% compared to a high rate taxpayer that has a capital gains tax rate of 28% ▶ There are ways to extend the Capital Gains Tax annual allowances. We will explain how to dispose of buy to let property investments whilst avoiding capital gains tax.. ===== Book a Finance & Tax consultation with Simon Misiewicz, the co found of Optimise Accountants the property tax specialists. Use the coupon code “YouTube25” to get the 25% discount Book your tax call now call: https://app.acuityscheduling.com/schedule.php?owner=19038952&appointmentType=13019925 |

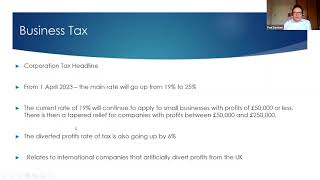

Budget 2021 highlights Live: Winners & Losers! | Rishi Sunak Budget statement for property Explained