NPV and IRR explained |

|

|

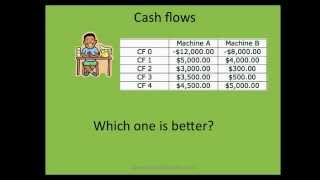

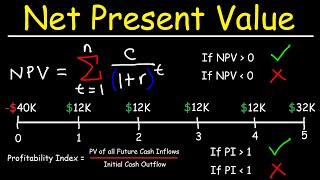

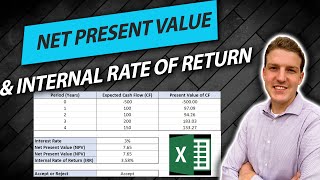

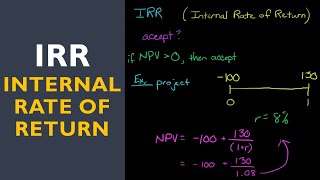

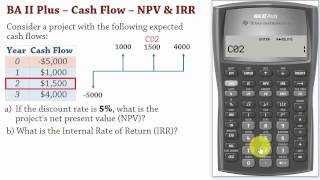

Net Present Value and Internal Rate of Return, in short NPV and IRR. What is the purpose of the NPV and IRR methods of investment analysis, and how do you calculate NPV and IRR?

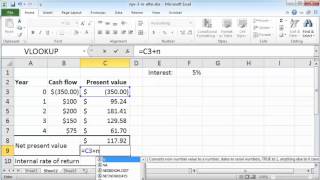

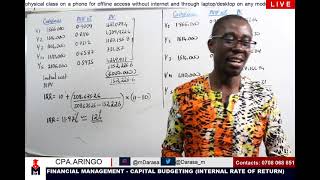

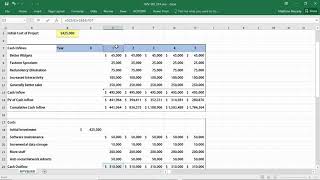

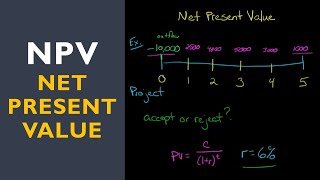

The main idea of Net Present Value is very simple: time is money! NPV is the core term in #capitalbudgeting The net present value (or “discounted cash flow”) method takes the time value of money into account, by: - Translating all future cash flows into today’s money - Adding up today’s investment and the present values of all future cash flows If the net present value of a project is positive, then it is worth pursuing, as it creates value for the company. IRR is the discount rate at which the net present value becomes 0. In other words, you solve for IRR by setting NPV at 0. Related videos: Net Present Value explained (including present value and future value): https://www.youtube.com/watch?v=N-lN5xORIwc Internal Rate of Return explained: https://www.youtube.com/watch?v=aS8XHZ6NM3U NPV IRR Payback period scenarios: https://www.youtube.com/watch?v=1ZTIwmn1Cm0 Time value of money https://www.youtube.com/watch?v=gkp-7yhfreg How to calculate #NPV in Excel https://www.youtube.com/watch?v=jQ_NDQ2qVVA How to calculate IRR in Excel https://www.youtube.com/watch?v=L0JCg5TXudc Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In! |

![IRR vs. NPV - Which To Use in Real Estate [& Why]](https://ytimg.googleusercontent.com/vi/hGw2J__2adU/mqdefault.jpg)