Capital Budgeting: NPV, IRR, Payback | MUST-KNOW for Finance Roles |

|

|

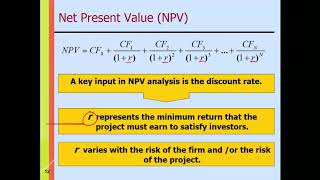

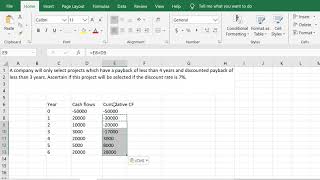

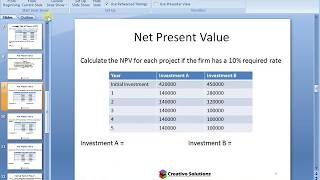

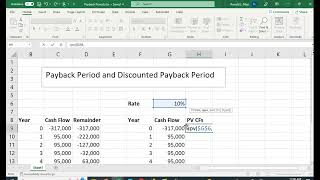

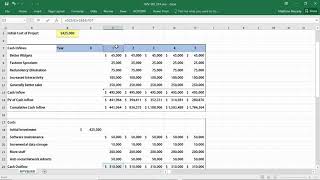

Learn the main capital budgeting techniques: NPV, IRR, and Payback Period using real-life examples on Excel.

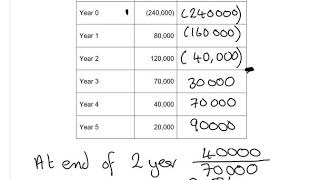

🆓 DOWNLOAD Free Excel file for this video: https://view.flodesk.com/pages/627e30c1216f0c9143607745 📈 The Complete Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course In the video you'll learn assess whether you should accept or reject a project based on the Net Present Value, the Internal Rate of Return, and the Payback Period calculation. Throughout, explain some of the limitations of each method. We'll go over the theory for each, and then we'll apply our learnings on Excel using their built-in formulas. Firstly, we'll introduce capital budgeting, going over what it means and what kind of projects are usually assessed using this method. Then, we'll introduce our scenario, which is working at Nike as a financial analyst and trying to decide whether to accept or reject the opening of two new Nike stores. For the NPV, we'll consider the time value of money, discount rates, and other important factors. For the IRR, we'll first explain the theory followed by using the IRR formula on Excel.Lastly, for the payback period we'll first calculate it and then introduce the Discounted Payback Period which does account for the time value of money. LEARN: 📈 The Complete Finance & Valuation Course: https://www.careerprinciples.com/courses/finance-valuation-course 👉 Excel for Business & Finance Course: https://www.careerprinciples.com/courses/excel-for-business-finance 📊 Get 25% OFF Financial Edge Using Code KENJI25: https://bit.ly/3Ds47vS SOCIALS: 📸 Instagram - https://www.instagram.com/kenji_explains/ 🤳 TikTok - https://www.tiktok.com/@kenjiexplains?lang=en GEAR: 📹 My Favorite Books & Gear: https://kit.co/kenjiexplains ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ Chapters: 0:00 - Capital Budgeting 0:41 - NPV 4:46 - IRR 7:12 - Payback Period Disclaimer: I may receive a small commission on some of the links provided at no extra cost to you. |

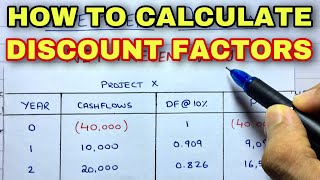

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R

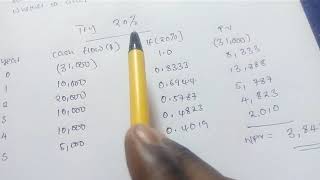

Financial Mathematics -Payback period, Net Present Value, Internal Rate of Return, Capital Budgeting

![[#1] Capital Budgeting techniques | Payback Period Method | in Financial Management | by kauserwise®](https://ytimg.googleusercontent.com/vi/fbhUm8W-iLk/mqdefault.jpg)

![[#2] Capital Budgeting Techniques | Discounted Payback Period Method | Solved problem by kauserwise®](https://ytimg.googleusercontent.com/vi/UfhgZ6HnVuE/mqdefault.jpg)