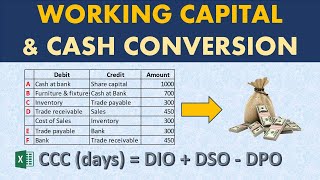

How to calculate Working Capital and Cash Conversion Cycle |

|

|

Course Alert:

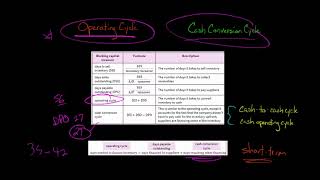

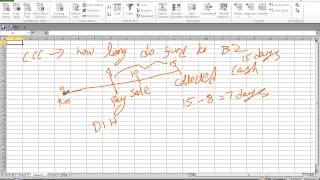

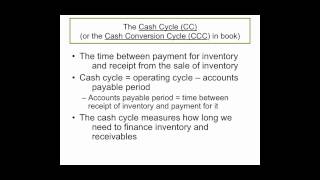

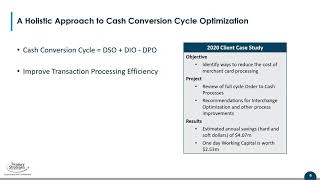

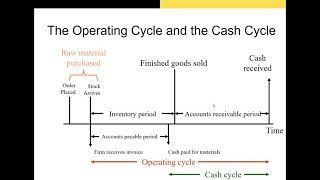

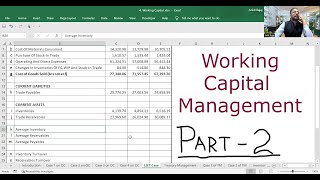

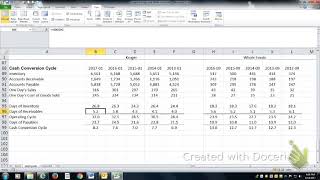

If you would like to learn in detail, how to calculate income statement variances and the impact they have on sales $, profit $ and profit margin % and ebitda %, and how to explain performance vs budget and prior periods, click on the link for a detailed video course (at a special price). You will also learn how to analyse and present the results of the variances to management and will be able to download solved variance calculation Excel templates. https://ebitda.thinkific.com/courses/learn Looking for more personalized help? Get in touch with me on one of these platforms: Instagram: https://www.instagram.com/learnaccountingfinance Facebook: https://www.facebook.com/profile.php?id=100063564513161 Tiktok: https://www.tiktok.com/@learnaccountingfinance Website: https://www.learnaccountingfinance.com Subscribe: http://www.youtube.com/c/LearnAccountingFinance?sub_confirmation=1 How working capital is calculated and how does it impact cash flow (cash Conversion cycle) In this video, I take you through the Balance sheet of a Company focusing on the transactions and accounting entries that impact the working capital of the Company. Videos you may like: Cash Conversion Cycle Explained in Simplest terms: https://youtu.be/ooGqAXpnXbs Learn sales and profitability analysis in detail here: https://youtu.be/CNx1Xu3DWVY Gross profit and gross profit margin explained: https://youtu.be/Px4pEhiTRdI How calculate selling price and profits on Etsy: https://youtu.be/WsrdSr_IIhM Standard Margin and Actual Margin - the Difference: https://youtu.be/p-Vbqh_j-ZY How calculate selling price and profits on Etsy: https://youtu.be/WsrdSr_IIhM Connect: https://www.instagram.com/learnaccountingfinance https://www.learnaccountingfinance.com Subscribe: http://www.youtube.com/c/LearnAccountingFinance?sub_confirmation=1 Some Recommendations: Accounting explained in 100 pages or Less: https://amzn.to/3rCProc Are you a First Time or New Manager? Check this out: https://amzn.to/35qWzLc Learn pivot table data crunching business skills here: https://amzn.to/3lgYB5E Learn all about Excel in one place: https://amzn.to/3laCXQx Learn what financial numbers really mean here: https://amzn.to/2HPYDUI Note: At no extra cost to you, I may receive some commission if you purchase using the links above. We start with the initial balance sheet when share capital is employed and cash is deposited in the bank account of the company. From there, we follow a number of transactions impacting the operating cycle and working capital cycle of the company. These transactions include purchase of inventory on credit from suppliers, sale of inventory on credit to customers and finally settlement of the amounts receivable from customers. The impact from each transaction on the working capital and balance sheet of the company is demonstrated. As you see the cycle complete, you see how cash conversion cycle is calculated by calculating the inventory collection period or Days Inventory Outstanding (DIO), accounts receivable collection period or Days Sales Outstanding (DSO) and account payable settlement period or Days Payable Outstanding (DPO). Sometimes, it is difficult to understand what is meant by working capital or investment in working capital. This video will show you exactly how working capital is calculated, and how transactions undertaken by an entity impact the working capital (changes in working capital), the impact of profits on working capital, and finally how all of these changes are linked to the Cash Conversion Cycle or working capital cycle of the company. You will also see the accounting entries (Debit or Credit) for each transaction and what type of transactions do not impact the working capital at all. Hope you find the information in the video helpful. If you like to watch more videos in accounting, financial analysis and controller ship, videos that help you directly in doing your job, subscribe to my channel. If you liked the video, I would love if you could LIKE it and leave a comment. If you have any questions or feedback, again leave a comment. Lets stay connected at #learnaccountingfinance. |