Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R |

|

|

Capital Budgeting Step-by-Step

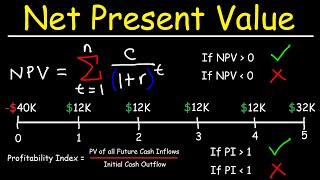

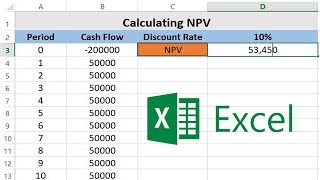

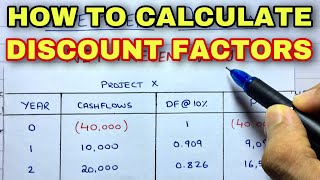

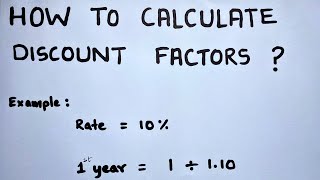

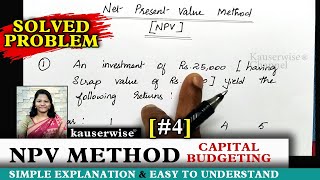

Introduction to Capital Budgeting *Net Present Value - NPV *Profitability Index *Internal Rate of Return - IRR (Time-Adjusted Rate of Return) *Payback Period, *Simple Rate of Return, Also called the Accounting Rate of Return or Accrual Accounting Rate of Return Time Value of Money – Present Value, Future Value *Use of Present Value (PV) and Future Value (FV) Tables, *Use of Financial Calculators – Recommendations, demonstration Capital budgeting is an area that focuses on investing in long-lived, expensive assets. Examples of capital expenditures (capital investments, capital projects) include, the acquisition of land, buildings, equipment, aircraft, vehicles, boats, construction equipment, manufacturing equipment, store equipment, manufacturing plants, retail store outlets, patents, copyrights, and others. Capital budgeting decision models are helpful for evaluating any and all costly projects that provide benefits for years to come. Introduction/Conceptual Coverage - This video introduces capital budgeting and various important concepts and considerations. Step-by-Step Calculations - The video also discusses the time value of money and provides various examples calculating both present value (PV) and future value (FV) of single cash flows as well as annuities (streams of equal cash flows with an equal time interval between each payment). Present value and future value calculations are demonstrated using both PV and FV tables as well as various financial calculators. The Texas Instruments BA II Plus, the Hewlett Packard HP 10b and HP 10c are discussed and used in the video. The video demonstrates and discusses the benefits and drawbacks of the most popular capital budgeting decision models including: *Net Present Value (NPV) for even and uneven cash flow streams *Net Present Value Profitability Index *Internal Rate of Return (IRR) for even and uneven cash flow streams *Payback Period for even and uneven cash flow streams *Simple Rate of Return The benefits and drawbacks of each capital budgeting model are discussed. For students, the video provides basic, step-by-step coverage that’s somewhat comparable to in-class introductory capital budgeting lectures in managerial or cost accounting. The video can provide the introduction, the extra review or tutoring students need to help them understand capital budgeting and how to do the calculations using tables and/or a financial calculator. Amazon Calculator Links: Texas Instruments Business Analysts II – BA II Plus (Popular among students, demonstrated in the video.): https://www.amazon.com/Texas-Instruments-Plus-Financial-Calculator/dp/B00000JZKB/ref=sr_1_1?dchild=1&keywords=ba+ii+plus&qid=1587655941&sr=8-1 Hewlett Packard 10b (Popular among students, shown in the video.): https://www.amazon .com/HP-10bII-Financial-Calculator-NW239AA/dp/B0002ABA8E/ref=sr_1_2?dchild=1&keywords=hp+10b&qid=1587655841&sr=8-2 Hewlett Packard 12c (Popular among financial professionals, demonstrated in the video.): https://www.amazon.com/HEWLETT-PACKARD-MAIN-86591-Platinum-Calculator/dp/B00009WNV9/ref=sr_1_1?dchild=1&keywords=12c&qid=1587656005&sr=8-1 Thank you for watching and best regards, Mike |

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R

Internal Rate of Return (IRR) | PBP | NPV | Model Question Solution | BBS 2nd year Finance Chapter 8

![[#1] Capital Budgeting techniques | Payback Period Method | in Financial Management | by kauserwise®](https://ytimg.googleusercontent.com/vi/fbhUm8W-iLk/mqdefault.jpg)

[#1] Capital Budgeting techniques | Payback Period Method | in Financial Management | by kauserwise®